Financial crises are like a shadow, never leaving your side even when you are earning a hefty amount each month. Whatever you earn, almost seventy to eighty percent of the paycheck is spent on meeting the monthly bills and needs. The rest twenty percent that you save is for any form of a future crisis. Still, then also, some people fail to solve the problems with their savings.

It is due to these reasons why lenders all across the US have started the concept of payday loans. These loans are usually granted within one day since the application and hence the name: PAY DAY. With no time complications, payday loans are becoming quite popular amongst the poor and the middle-class economic people.

However, before you apply, don’t you think that you must know about both the benefits and risks of the short term loans Michigan?

Obviously yes and that’s what we are going to discuss today!

Benefits of Payday Loan Credits

The very first thing we need to discuss is the various benefits of this particular loan type. With the advantages known, you will be able to decide whether you want to apply for the instant payday loan or the traditional loan.

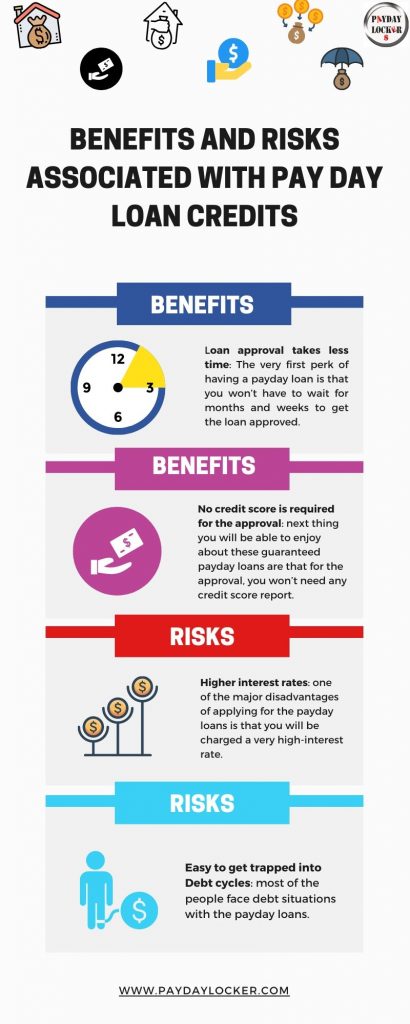

- Loan approval takes less time: the very first perk of having a payday loan is that you won’t have to wait for months and weeks to get the loan approved. Most of the lenders usually go with the instant approval process, based on the criteria you are looking for. The maximum time taken to grant the loan is one day, or you can say twenty-four hours.

- No credit score is required for the approval: next thing you will be able to enjoy about these guaranteed payday loans are that for the approval, you won’t need any credit score report. A credit report is a consolidated data sheet that contains every detail about the transactions done with your credit card. The credit point is dependent on the dues, the bills, and loan debts. Since for most of the people, the credit point doesn’t meet the requirement, they cannot apply for traditional loans. But, yes, the payday loans don’t require the credit report.

- Can be applied both online and offshore: with the payday loans, you will have options in terms of the lender. There are offshore agencies who give away the quick cash loans. Apart from this, there are many online agencies too who grant the payday credits like Payday Locker.

- People from all classes can apply for payday loans: there are no restrictions when it comes to the payday credits. Even if you are jobless or your monthly paycheck isn’t in five figures, you will be able to apply for such loans easily. After all, the lenders don’t ask for your income statement at the time of document verification.

- They are the best option for solving financial emergencies: traditional loans are usually taken for bigger purposes like buying a car, building your own home, or for meeting the educational expenses. However, the payday loans are mainly taken for meeting any financial emergencies at short notice.

Risks Associated With the Payday Instant Loans

Now, since you are aware of the benefits, our next concern will be for the various risks that are associated with the online payday loans Michigan.

- Higher interest rates: one of the major disadvantages of applying for the payday loans is that you will be charged a very high-interest rate. Usually, the interests are so high that the borrowers end up paying more than what they had borrowed for the first time.

- Easy to get trapped into debt cycles: most of the people face debt situations with the payday loans. Once you fail to pay a single installment for the payday loan, you will find yourself under a huge debt cycle which only increases with time.

- Doesn’t involve a huge sum of principal: with the traditional loans, you will be able to apply for a large principal like fifty thousand dollars or a hundred thousand dollars as per your requirement. However, in the case of the payday loans, the principal is of only a few hundred dollars. All across the country, the maximum level of the loan amount is around fifteen hundred dollars.

- Payment term is almost instant: you won’t get a time limit of a year or more to repay the loan. In the case of the online payday loans in Michigan, you will be asked to repay the debt within a few weeks or at most two to three months. Failure to pay the amount will increase your debt amount.

Conclusion

Now since you are aware of both the advantages and disadvantages of the payday loans, it will be your job to weight both the perks and risks and decide whether the loan is beneficial for you or not.