Whether you feel like your finances are a mess and you don’t know where the money goes every month, or you want a better handle on your spending and saving records, I highly recommend keeping a monthly budget. I know, I know, people always complain that they don’t want to keep a budget, or that their finances are too complicated for a budget. The simple truth is, once you learn how to create a zero-based budget in Excel, keeping a budget is quite easy. And if you’re short on cash, that’s all the more reason why you should keep a budget.

Why Keep a Budget?

A budget can be helpful at the beginning of the month to act as a map. This map tells you how much you have to spend and save and helps direct how you use your money.

At the end of the month, when you fill in what you spent, the budget serves as a financial journal, so to speak. I find it very helpful at the end of the year to see how much I spent on groceries, miscellaneous, etc. That helps me make next year’s budget. Also, if my savings is smaller than I would like, looking over past expenditures helps me see what was the cause.

Why Use Excel?

There are so many budgeting software programs out there. Why not use one of them? Well, you certainly can, but I’ve discovered that most of them charge a monthly or yearly fee. I don’t know about you, but I find it irritating to pay $5 to $8 a month just to have a platform for maintaining my budget. However, after you initially buy Excel, it’s completely free! And, once you learn how to use Excel, it’s easy to use.

Sure, you could keep your budget on paper, and I did that when my husband and I were first married. However, as finances get more complicated, a paper budget is harder to maintain. It’s also harder to evaluate your spending at the end of the year because you can’t organize it by categories and expenditures.

What Is a Zero-Based Budget?

A zero-based budget simply means that each paycheck, you plan expenditures that are equally to your income. So, if you create your budget, and you discover you have an extra $200, you don’t just leave it sitting there. (Most people will slowly pitter away that money during the month.) Instead, you earmark that extra money for something. Maybe it goes to your emergency fund. Maybe it goes to debt repayment. The point is, you give that money a job so you don’t spend it because you see it as “extra.”

How to Create a Zero-Based Budget in Excel

Creating a zero-based budget in Excel is fairly easy and quick.

Create Categories First

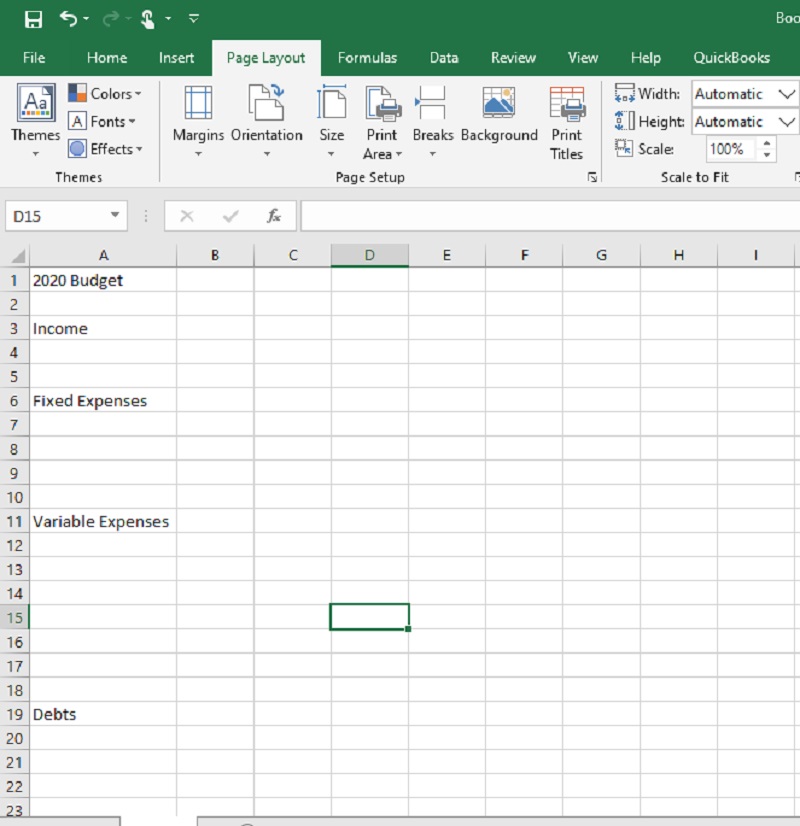

When you start your budget, you’ll want to have several categories. These categories will run vertically down your Excel column.

Categories to Add to The Budget

The first column should have several major categories:

- Income

- Fixed Expenses

- Variable Expenses

- Debt

These categories represent your income and all expenses for the month.

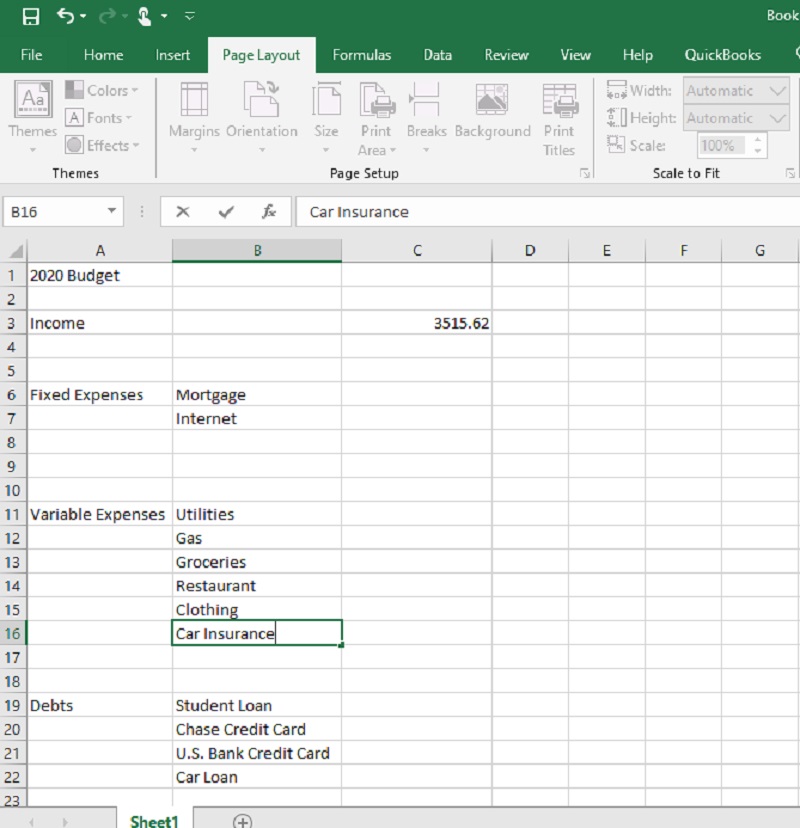

Fixed expenses will be those expenses that are the same month after month. Think rent or mortgage, cable & internet, etc.

Variable expenses will be those expenses that vary every month such as gas, groceries, spending, utilities, etc.

Debt will obviously include all of your debt such as credit card payments, student loan payments, car payments, etc.

By now your Excel spreadsheet should contain two columns. The first should be the broad categories of income, debt, fixed expenses and variable expenses.

The next column should contain the names of all of those particular expenses.

Get Ready to Record Data

After that, you should have two new category headings, each in their own column—Budgeted and Actual.

At the beginning of the month (or pay period), you will put in the budgeted amount you plan to use for each category.

As you incur expenses, you will put the actual spending under the “Actual” column heading.

Customize to Your Choosing

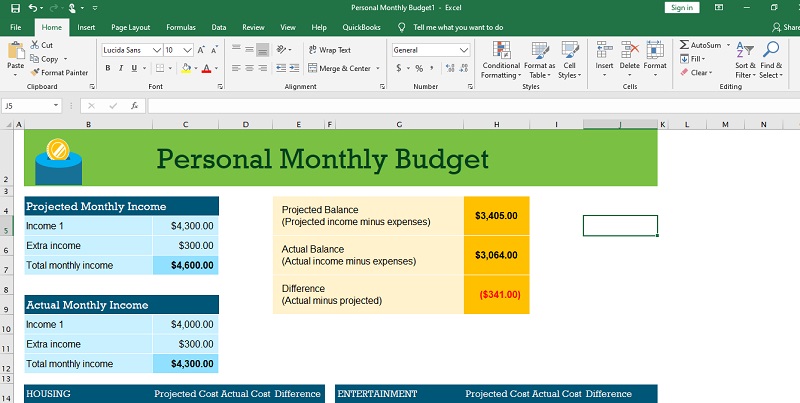

At this point, you can customize how you would like. Some people focus on the aesthetics and make each column a different color.

Some people budget for the entire month, while other people budget for each paycheck in the month, whether that be four or five for a weekly paycheck or two paychecks for a bimonthly payment. You decide what works best for you.

Keep in mind, if you look in Excel, you don’t need to create such a simplified budget. Excel has plenty of budget templates already designed for you such as this:

What If You Don’t Know How to Use Excel?

What if you’re convinced you need a budget, but you are intimidated because you don’t know how to use Excel? No worries.

There are plenty of free online tutorials that can teach you how to use Excel. If you’re a visual person, check out YouTube tutorials. If you prefer online websites that explain how to use Excel, there are plenty of those, too.

For the most part, learning how to create a zero-based budget in Excel only requires the most remedial Excel knowledge.

The only tricky part is that in some places in your budget, you will likely want to add a calculation formula. For instance, if you have a category for “Emergency Fund” and at the end of the month you want the $400 you saved this month to be combined with the $600 you saved last month, you’ll need a calculation formula. Again, this is easy to learn in less than two minutes through a video like the one below:

Final Thoughts

Learning how to create a zero-based budget in Excel will be worth your time! Once you have the budget set up, you can create a plan for your spending and also track how you spent your money at the end of the month. When you have a clear view of how you’re spending your money, you’ll be able to have more control of your money. As a result, your financial situation should improve.